United Emirates Banking Sector

United Emirates banking sector recorded an approximate of 11.5% profits. The profits were realized among the 10 leading banks in UAE (United Arab Emirates). After the international accounting standards (IAS) with replacement IFR in 2018. The bank approach was transformed in improving access to loan portfolios. Liquidity cost was spiked by net stable funding ratio and coverage ratio. The adjustments that came along with the implementation of IFRS, included retained earnings., this led to an impact felt from the return on equity and capital adequacy ratio. Introduction of digitally enabled banking sector has improved the adoption of innovation teams to help foster the banking sector in UAE.

Financial institutions and banks in the UAE zones have been on a recruiting spree of innovation specialist. This is the current formal business that is emerging in the banking sector. Zones such as Abu Dhabi and Dubai international financial center are considered financial free zones, where there are regulations put in place to improve the innovation of new financial services and products. The banking sectors in UAE need to invest in innovation and technology advancement in order to maximize their profits. Currently the banking sectors in the UAE are recording 11.5% net profits. This means that the value is comparable to Bank of America, JPMorgan Chase, Wells Fargo, that has it median ROE to be 11.5 %. Improving various innovation and technological aspects can improve the UAE banking sector to global banking relevance.

Banking sectors is an evolving sector, where the customer needs should be supplemented in line with the existing demands and supplies. customer service delivery determines the profits the banks assumes regarding the financial, social, political and the technological needs of the customer. UAE banks are trying in terms of service delivery and innovation, especially those based in Abu Dhabi and Dubai.

Structural changes

The future of the millennial generations relies on technology and innovations. Banks in the United Arab Emirates are taking innovation seriously to help improve the future profitability in terms of customer satisfaction (Grant, 64). Customer needs are essential in any banking sector, and its ability to meet the demands of the customer helps in increasing the revenues and the foreseen profits. service renovation such as digital banking, loan access free interest rate among products offered by the banks on lease are to mention regarding improved profit margins. In order to attain full innovation, UAE banks need to embrace full life cycle of the innovation process i.e. from ideation, incubation, and implementation stage. Proper funding is paramount to ensure that the innovation ideas are implemented to serve on the needs of the customers.

Outlook for profitability in the future?

United Arab Emirates banking sectors have concentrated on digital transformation to make more profits. Customers have more expectations from the banking sectors, and this include ensuring there is easiness in using digital interaction with the mobile banking apps, internet banking, automated teller machines, call centers and reality interface. In cases where the digital application has matured functionalities, processes such as know your customer, could be used in verifying the identity of the bank user. In this aspect, there is assumed safety, time and cost, initially used in covering up the offline know your customer identification and surveillance.

Applying Porter’s 5 forces framework

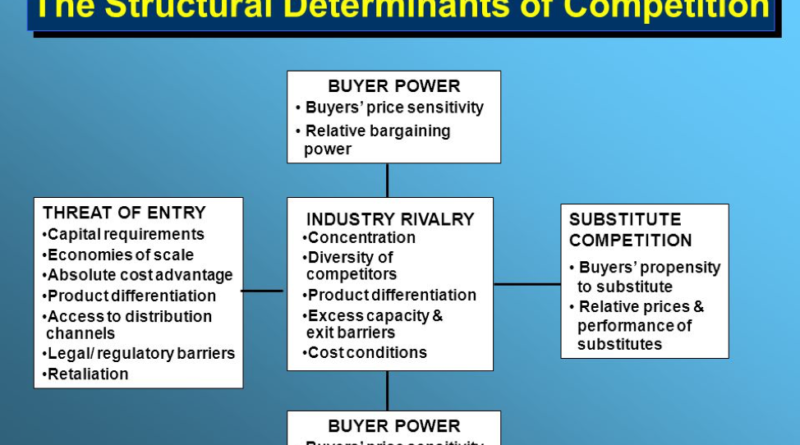

Porter’s five is a theory used in assessing the competitiveness of a firm between one firm and others in the same field (Grant, 78). The figure below shows the structural features used in porter’s model in determining the competition existing among the rival firms.

Threat to market entry

UAE banking sectors faces the challenge of new entry market from small digital banks, opting to offer their services to UAE citizens. The economies of scale offer a benefit of doubt to the customers, since they have more bargaining power as compared to new entrants in the market. Good liquidity at the bank makes it accessible for their customers to access loans and mortgages with low interest rates (Grant, 68). Subdivision of the banks into 8- 10 branches helps in handling the issue of new small banks penetrating the market. For example, Qatar national bank, Doha bank, Abu Dhabi bank and others are well established in the region. Leaving few or less chances for new entrants to penetrate. ADCB bank serves about 7 million clients per year; this means the bank is able to gain more clients through subdividing the banks to serve a larger population.

Threat of substitutes

Existence of various banks offering the same services to clients, offers a challenging opportunity for the UAE banks to remain relevant in the market (Grant, 68). In order to increase the profitability index, the banks, should provide unique services to customers to earn their trust and help them to remain relevant in the market.

Power of suppliers

UAE banking such as Dubai Financial services authority and Royal bank of Scotland, supplies the UAE banks, they have more bargaining in terms of supply and demand. These two banks have more power regarding the UAE banks. UAE Central bank offers financial services to UAE commercial banks. ADCB is this case, has managed to attain an equilibrium on the supply of lending and interest rates among the banks.

Power of buyers

The financial ability of the bank’s customers is realized through its turnover. The ability of UAE banks to offer investment, insurance, wealth management services, mortgage and loans, opening and closing of accounts is very paramount. ADCB bank offers a variety of services to customers, thus a number of the customers prefer trading with ADCB. The profitability of banks is determined by the profitability of the gods and services offered. The higher the demand of the bank’s goods and service, the higher the profitability. a bank with a high purchasing powers realizes more profits.

Rivalry

Existence of different types of banks within the UAE, offers rivalry in the banking business. Commercial bas in the UAE belt deal so much with the multiplicity of services and monetary products (“UAE Banking Perspectives 2019 | AE). In this essence, ADCB banks and the commercial banks, are rivals in the banking sector, this is since the customers may prefer one bank over the other due to the types of services offered.

Drawing industry boundaries

Industry is defined by economists as a group of firms that provide supplies to the market. According to the economists, define industries on a wide perspectives and markets are defined by specific products. Banking is an industry that offers various products and services. These include corporate banking, retail banking, wholesale banking and or investment banking. Each of the products can be subdivided to various components of the banking services for example, in the retail banking; there are credit cards, deposits, transaction services, loans and mortgage lending. Investment banking entails underwriting, trading, advisory services for acquisitions and merger.

The UAE banks can reduce the competitiveness from other banks through ensuring that the services offered are unique and customer centered. The commercial bank has a distinct role of offering multiplied monetary, in order to remain competitive, the bank should diversify to ensure that the goods and services offered are

Identifying Key Success Factors (KSFs):

UAE banking sector has various success factors. According to the UAE banking report, it indicates that there is an increase in online banking platforms. In UAE some of the key success factors include; are the customers getting the needs that they want? Are customer services rendered among the banks beneficial to the customer needs? are customers satisfied with the products and services offered by the bank?

References

Grant, Robert M. Contemporary strategy analysis: Text and cases edition. John Wiley & Sons, 2016.

“UAE Banking Perspectives 2019 | AE.” KPMG. N.p., n.d. Web. 25 Sept. 2019.

![]()